Content Summary

Retirement marks a significant milestone in life a time when individuals bid farewell to the workforce and embark on a new chapter filled with leisure, relaxation, and pursuing passions.

However, achieving a comfortable retirement requires thoughtful planning, disciplined saving, and a clear understanding of the financial dynamics involved. This article serves as a comprehensive guide to retirement planning, addressing key questions about when to start, how long to save, and how much is needed for a comfortable retirement.

Planning for Retirement: A Holistic Approach

1. When to Start Building Retirement Savings

The adage "the earlier, the better" holds true when it comes to retirement planning. Ideally, individuals should start building their retirement savings as soon as they begin their careers.

The power of compounding the ability of investments to grow over time works most effectively when given a longer runway. Even small contributions made early can have a substantial impact on the eventual size of the retirement nest egg.

2. The Importance of Consistent Contributions

Retirement planning is a marathon, not a sprint. Consistency in contributing to retirement accounts, such as 401(k)s or IRAs, is crucial. Automated contributions can help ensure that savings remain on track regardless of market fluctuations or changing circumstances.

3. Calculating Your Retirement Needs

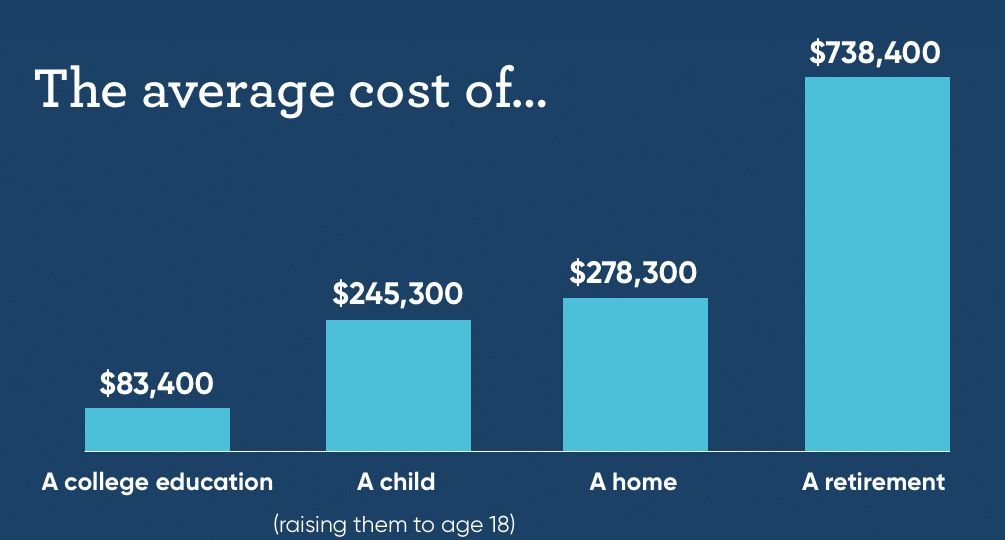

Determining how much money is needed for a comfortable retirement depends on various factors, including lifestyle expectations, anticipated expenses, and retirement goals. A common rule of thumb is the "4% rule," which suggests that individuals can withdraw 4% of their retirement savings annually while still maintaining a sustainable balance.

4. Evaluating Retirement Duration

Life expectancy is on the rise, and individuals are living longer than ever before. This means that retirement savings need to last longer. To ensure financial security, it's prudent to plan for a retirement period of 20 to 30 years or more. Social Security and other pension benefits should also be factored into this equation.

Strategies for Retirement Success

1. Diversification and Asset Allocation

Diversifying investments across various asset classes can help manage risk and maximize returns. As retirement approaches, gradually shifting from riskier investments to more conservative options can protect accumulated savings.

2. Professional Financial Guidance

Consulting with a financial advisor can provide invaluable insights tailored to individual circumstances. Advisors can help create a retirement plan, set achievable goals, and make informed investment decisions.

3. Health Care Considerations

Healthcare costs often increase in retirement. Enrolling in Medicare and considering supplemental health insurance are essential steps to ensure comprehensive coverage during retirement.

4. Flexibility and Adjustments

Life is full of surprises, and retirement plans may need adjustments. Being adaptable and open to modifying retirement strategies as circumstances change is essential.

Most FAQs about Retirement Planning:

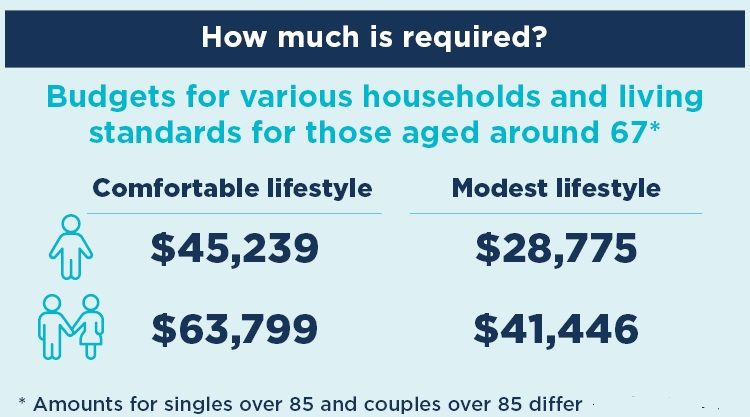

How Much Money Do I Need to Retire Comfortably?

As life expectancy for Americans increases, the projected cost of achieving a comfortable retirement is steadily rising. On average, individuals in the United States indicate that a minimum of $1.27 million is required to fund a retirement that allows them to unwind, enjoy quality time with family, and pursue leisure activities.

When Should I Start My Retirement Savings?

The best time to start your retirement savings is as early as possible. The power of compounding, where your investment earnings generate further earnings over time, is most effective when given more time to work. Starting early allows you to take full advantage of this compounding effect and build a solid financial foundation for your retirement years.

Here are a few key reasons why starting your retirement savings early is highly beneficial:

Maximizing the Power of Compounding: The longer your money is invested, the more time it has to grow through compounding. Even if you start with smaller contributions, the compounding effect can lead to significant growth over the years.

Smaller Contributions Needed: Starting early means you can contribute smaller amounts of money each month to reach your retirement goal, as opposed to needing larger contributions if you start later in life.

Mitigating Risk: Starting early gives you more time to recover from potential market downturns or economic challenges. You have the flexibility to weather short-term fluctuations in the market and benefit from the long-term upward trend.

Reducing Stress: As retirement approaches, having a well-funded savings cushion can reduce stress and anxiety about your financial future. You'll have the peace of mind knowing that you've been diligently preparing for your retirement.

Flexibility in Investment Choices: Starting early allows you to adopt a more balanced and risk-appropriate investment strategy. You can take advantage of potentially higher returns from more growth-oriented investments while having time to recover from any short-term losses.

It's important to note that it's never too late to start saving for retirement, even if you haven't done so early in your career. Every bit you save and invest contributes to your financial security in retirement. However, the earlier you begin, the greater the potential benefits you can reap from compounding.

Remember, the specific amount you save and the investment choices you make should align with your financial goals, risk tolerance, and overall financial plan.

What is the Average Retiring Income in Canada?

At present, the average annual retirement income in Canada stands at $65,300 per household before taxes. If the household consists of a couple, this amounts to approximately $32,650 per person.

What is the Average Retiring Income in the USA?

As of September 2021, the average retirement income in the United States can vary based on factors such as individual savings, pensions, Social Security benefits, investments, and other sources of income.

According to data from the U.S. Bureau of Labor Statistics (BLS) for 2020, the average annual household income for those aged 65 and older was around $53,700 before taxes. This figure takes into account all sources of income, including Social Security benefits, pensions, earnings from employment, and investments.

It's important to note that retirement income can vary significantly based on factors such as retirement savings, employment history, location, marital status, and individual financial choices. Social Security benefits also play a crucial role in retirement income for many Americans.

For the most current and accurate information regarding average retirement income in the United States.

How Long Will a Canadian Receive Pension After Age of 65?

In Canada, the age at which you can begin receiving your government pensions, such as the Canada Pension Plan (CPP) and Old Age Security (OAS), is 65. However, there are a few important points to consider regarding the duration of pension payments:

Canada Pension Plan (CPP): While the standard age to begin receiving CPP benefits is 65, you can choose to start receiving benefits as early as age 60 or delay them until as late as age 70. If you start CPP before 65, your monthly benefits will be reduced, and if you delay CPP after 65, your benefits will increase.

Old Age Security (OAS): The standard age to start receiving OAS benefits is 65. However, starting in July 2023, the OAS eligibility age will gradually increase to age 67 by 2029. This means that if you were born after April 1, 1962, your OAS eligibility age will be 67. Like CPP, you can choose to delay OAS benefits to receive a higher monthly amount or start early for a reduced amount.

Survivor's Pension: If you receive a survivor's pension based on a spouse's or common-law partner's CPP contributions, the length of time you receive this pension depends on your circumstances. For example, if you remarry or start a new common-law relationship, you might not be eligible to continue receiving the survivor's pension.

It's important to note that both CPP and OAS payments are intended to provide income throughout your retirement years. They do not have a specific end date as long as you are alive and eligible to receive the benefits.

However, the age at which you choose to start receiving these benefits and any potential changes to eligibility criteria can impact the duration and amount of pension payments you receive.

For the most accurate and up-to-date information regarding the duration of pension payments in Canada, it's recommended to consult official government sources such as the Government of Canada's website or the Canada Pension Plan and Old Age Security websites.

Author's Choice of Retirement Planning Strategies Tools:

In this book, you'll learn:

- Why the best way to describe most retirement estimates is garbage-in/garbage-out

- The five critical assumptions that can destroy your financial security

- How to reduce the amount you need to retire by as much as $600,000

- Three strategies to maximize spending today while protecting for the future

- How to calculate the amount of money you really need to retire on the first try without software, online calculators, or being a math genius

- The Retirement Planning Guidebook helps you navigate through the important decisions to prepare for your best retirement. You will have the detailed knowledge and understanding to make smart retirement decisions:

- Understand your personal retirement income style, which can then help you navigate through the conflicting opinions about retirement strategies to choose your right path.

- Learn about investment and insurance tools that may best resonate with your personal style.

- Determine if you are financially prepared for retirement by quantifying your financial goals (annual spending, legacy, and reserves for the unexpected) and comparing them to your available assets.

- Make smart decisions for when to start Social Security benefits, which could potentially support an additional $100,000 or more of lifetime income from Social Security.

- Did you know that there is more than one way for retirees to meet their financial goals? Not everyone is comfortable relying on stock market returns from their investments.

- This book explains a different approach that first builds safety through a floor of reliable lifetime income.

- This is the meaning of safety-first retirement planning.

- How risk-pooling through insurance works

- Why risk pooling is a source of additional spending that is competitive with potential stock market returns

- How commercial annuities provide this risk pooling in the same manner as Social Security or traditional company pensions

- How replacing some bonds with insurance-based risk pooling assets can improve the odds for retirees to meeting their spending goal and to support more legacy at the end of life

Conclusion

In conclusion, retirement planning is a journey that demands proactive preparation and strategic decision-making. Starting early, contributing consistently, and adopting prudent investment strategies are key elements in building a solid financial foundation for retirement.

While there is no one-size-fits-all answer to how much money is needed for a comfortable retirement, careful planning and thoughtful consideration of personal goals can lead to a fulfilling retirement filled with financial security and the freedom to enjoy life to the fullest.

Happy Retirement!

Relevant Reads>>>