Content Summary

The Link Between Soft Skills and Money: Understanding the Psychology of Wealth

In the intricate web of modern society, money is undeniably a powerful force. It not only facilitates transactions and fulfills material desires but also often stands as a symbol of success and achievement.

However, the pursuit of financial prosperity is not solely governed by the accumulation of technical knowledge and expertise. Soft skills, those often intangible and interpersonal abilities, play a crucial role in shaping an individual's financial journey.

To comprehend this link between soft skills and money, it's imperative to delve into the psychology of money.

The Psychology of Money: Beyond the Dollar Signs

Money is more than just a medium of exchange; it carries profound psychological implications. People's attitudes, behaviors, and relationships with money are deeply rooted in their upbringing, culture, experiences, and personal values. These psychological factors influence how individuals approach earning, spending, investing, and saving.

"Controlling Your Time is the Highest Dividend Money Pays" is a phrase that emphasizes the value of time and personal freedom over financial wealth. This idea suggests that the true benefit of having money is not just the ability to buy things, but rather the power to have control over how you spend your time and live your life.

In essence, the phrase conveys the notion that the ultimate reward money offers is the opportunity to make choices that align with your passions, priorities, and aspirations.

While money can certainly provide comfort and security, its most significant value lies in affording you the freedom to allocate your time as you see fit, rather than being tied down by obligations or financial constraints.

This concept highlights the distinction between mere financial wealth and the broader idea of wealth that encompasses overall well-being, happiness, and a fulfilling life.

It encourages individuals to consider their life goals beyond monetary acquisition and to recognize that having more time for meaningful experiences, relationships, personal growth, and pursuing passions is a priceless dividend that money can provide.

In a world where the pursuit of wealth can sometimes overshadow other aspects of life, this phrase serves as a reminder that true prosperity is a holistic blend of financial stability and the ability to enjoy the most valuable resource of all: TIME.

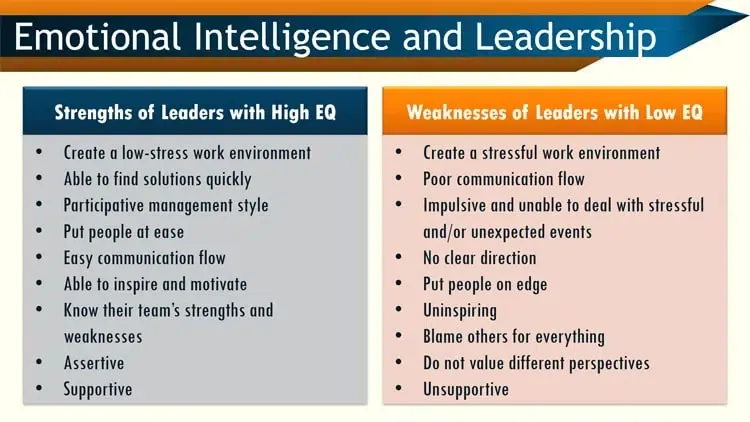

Emotional Intelligence and Financial Success

Emotional intelligence is one of the most prominent soft skills that can significantly impact financial outcomes. Emotional intelligence involves recognizing, understanding, managing, and effectively using one's own emotions as well as understanding and influencing the emotions of others.

People with high EQ tend to make more informed and rational financial decisions, avoid impulsive spending, and negotiate better in financial transactions.

For instance, an individual with strong EQ might excel in negotiations, landing them better job offers or favorable terms in business deals. EQ contributes to effective communication, fostering better relationships with colleagues, clients, and superiors – factors that can lead to promotions and increased earning potential.

Communication Skills and Professional Growth

Effective communication is a cornerstone of both personal and professional success. Strong communication skills encompass active listening, persuasive speaking, and clear writing.

In the context of wealth, communication skills can enable individuals to articulate their ideas persuasively, leading to successful sales, negotiations, and collaborations.

Furthermore, these skills enable individuals to convey their expertise and insights through various mediums, such as writing articles, giving presentations, or hosting workshops. This visibility can enhance their professional reputation and potentially open doors to lucrative opportunities.

Adaptability and Financial Resilience

The ability to adapt to change and navigate uncertainties is crucial in the dynamic world of finance. Adaptability enables individuals to stay current with evolving market trends, seize emerging opportunities, and navigate financial setbacks.

Those who possess this skill are better equipped to recover from financial downturns, adjust investment strategies, and explore new avenues for income generation.

Adaptability also extends to embracing technological advancements in the financial sector. As industries increasingly integrate technology, individuals who are open to learning and adopting new tools are more likely to identify innovative ways to manage their finances and discover new income streams.

Networking and Leveraging Connections

In the modern age, networking has evolved into an indispensable skill for both personal and professional advancement. Building and maintaining a strong network can lead to opportunities that may not be otherwise accessible. From career growth to business partnerships, networking can significantly impact one's financial trajectory.

Soft skills like active listening, empathy, and relationship-building play a pivotal role in successful networking. Individuals who can genuinely connect with others understand their needs, and offer value are more likely to forge mutually beneficial relationships that can translate into financial gains.

Most FAQs about Money and Successful Life Balance:

What is the Definition of Wealth?

Wealth is a multifaceted concept that extends beyond mere financial accumulation. It encompasses various dimensions of well-being and prosperity, reflecting a comprehensive evaluation of an individual's or a community's resources, opportunities, and overall quality of life.

While commonly associated with monetary riches, wealth incorporates a broader range of assets, both tangible and intangible, that contribute to a fulfilling and satisfying existence.

Key Dimensions of Wealth:

Financial Resources: Financial wealth is one of the most recognizable aspects of prosperity. It involves the accumulation of money, assets, investments, and resources that provide economic security, enable the fulfillment of basic needs, and allow for discretionary spending.

Physical Well-being: Good health and access to quality healthcare are vital components of wealth. Having the physical ability to engage in daily activities, pursue passions, and enjoy life without hindrance contributes significantly to overall well-being.

Intellectual Capital: Knowledge, education, and skills are forms of wealth that empower individuals to make informed decisions, seize opportunities, and contribute meaningfully to society. Intellectual capital can lead to personal growth, career advancement, and innovation.

Emotional and Mental Well-being: Emotional resilience, mental health, and a positive mindset are essential aspects of wealth. Emotional well-being enables individuals to navigate challenges, build strong relationships, and experience a higher quality of life.

Social Connections: Strong social networks and relationships are valuable assets that contribute to emotional support, personal growth, and a sense of belonging. These connections enhance overall happiness and contribute to a rich and fulfilling life.

Time Freedom: As mentioned earlier, the ability to control one's time and engage in activities that bring joy, personal fulfillment, and relaxation is a significant form of wealth. Time freedom allows individuals to pursue their passions, spend quality time with loved ones, and engage in self-care.

Cultural and Spiritual Enrichment: Cultural experiences, spiritual beliefs, and a connection to one's heritage add depth and richness to life. These aspects contribute to a sense of identity, purpose, and a broader perspective on the world.

Environmental Sustainability: A healthy environment and access to natural resources are integral to long-term well-being. Living in a clean and sustainable environment contributes to physical health, mental well-being, and the ability to enjoy nature's beauty.

The definition of wealth transcends financial measures and encompasses various dimensions of prosperity. It is the accumulation of resources, experiences, relationships, and well-being that collectively create a fulfilling and meaningful life.

Recognizing the multifaceted nature of wealth encourages individuals and societies to pursue holistic well-being and embrace a more comprehensive perspective on prosperity.

How Much Money Does Someone Need to be Considered Wealthy?

The amount of money that is considered "wealthy" can vary significantly depending on factors such as location, lifestyle, personal preferences, and individual financial goals. There is no universal threshold that defines wealth, as it is a subjective concept influenced by various circumstances.

In some regions or countries, a certain level of income or net worth might be considered wealthy due to the cost of living, economic conditions, and social norms.

In other areas, the same amount might be considered middle-class or even lower-income. What constitutes wealth to one person might not necessarily be the same for another, as people have diverse aspirations and priorities.

For some individuals, being wealthy might mean having enough financial resources to cover their basic needs, pursue their passions, and enjoy a comfortable lifestyle without worrying about money.

Others might view wealth as having the ability to make significant contributions to causes they care about, travel extensively, or have a substantial financial cushion for future generations.

In popular discussions, terms like "millionaire" or "billionaire" are often associated with wealth. However, even within these categories, there can be varying degrees of financial security and lifestyle. Some millionaires might consider themselves wealthy, while others might feel that their wealth is still tied to their business endeavors or investments.

Ultimately, being wealthy is a relative concept, and what matters most is an individual's perception of their own financial well-being and the level of comfort and security they experience.

It's important to focus on aligning financial goals with personal values and aspirations rather than attempting to fit a specific monetary label of wealth.

What are the Four Categories of Wealth?

Wealth can be categorized into four main dimensions, each representing a different aspect of an individual's or a society's prosperity. These categories of wealth help provide a more comprehensive understanding of the various resources and factors that contribute to well-being and a fulfilling life:

- Financial

- Social

- Time

- Health

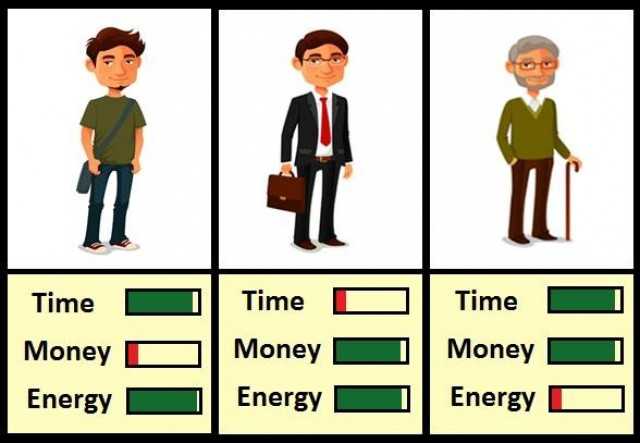

What is More Valuable Time or Money?

The question of whether time or money is more valuable is a complex and subjective one. Both time and money have their own unique significance, and their value can vary greatly depending on individual circumstances, priorities, and perspectives. Here are some considerations for both sides of the argument:

Time's Value:

Limited Resource: Time is a finite resource; once it's gone, it cannot be reclaimed. Every moment that passes is irreplaceable, which makes time incredibly valuable.

Quality of Life: Spending time on activities that bring joy, fulfillment, and meaningful experiences contributes to a higher quality of life. These moments often become cherished memories that shape one's overall happiness.

Relationships: Investing time in building and nurturing relationships with loved ones and friends is essential for emotional well-being and a sense of belonging.

Personal Growth: Time allows for self-reflection, learning, and personal development. Engaging in activities that enhance skills, knowledge, and self-awareness can lead to personal growth and increased life satisfaction.

Money's Value:

Access to Resources: Money provides access to goods, services, and opportunities that can enhance one's quality of life. It can cover basic needs such as food, shelter, and healthcare.

Financial Security: Having money saved and invested can offer financial security and peace of mind in times of unexpected expenses or emergencies.

Freedom and Choices: Money can afford individuals the freedom to make choices that align with their preferences and aspirations. It can enable travel, education, and pursuing hobbies and passions.

Charitable Contributions: Money can be used to support charitable causes and make a positive impact on society. Philanthropy and donations contribute to the betterment of communities and the world.

Balancing Time and Money:

The decision between valuing time or money often comes down to finding a balance that suits one's circumstances and priorities. For some, having more time might be more valuable, allowing them to prioritize experiences, relationships, and personal growth.

For others, accumulating wealth and financial security might take precedence, leading them to allocate time toward work, investment, and building their financial foundation.

Ultimately, the choice between time and money is a deeply personal one. Striking a balance between the two can lead to a fulfilling and well-rounded life.

It's important to assess individual goals, values and needs to determine how best to allocate both time and money to create a life that aligns with one's unique aspirations.

What is the Time Money Paradox?

The "time money paradox" refers to the concept that there is an inherent trade-off between time and money. This paradox highlights the tension between dedicating time to earn money and using money to buy back time.

In other words, individuals often face the dilemma of choosing between investing time to earn a living and spending money to free up time for leisure, relaxation, and meaningful experiences.

Author's Choice of Money Education Tools>>>

Conclusion

The link between soft skills and money goes beyond mere correlation; it reflects a complex interplay between psychology, behavior, and financial outcomes. While technical expertise is undoubtedly valuable, soft skills provide the emotional and interpersonal tools that empower individuals to navigate the intricate world of finance with finesse.

From emotional intelligence to adaptability, communication, and networking, these skills amplify an individual's ability to make informed decisions, cultivate resilience, and seize opportunities that pave the way for financial success.

As the landscape of work and economics continues to evolve, recognizing and honing these soft skills can be the differentiating factor in achieving one's financial goals.

I wish you wealthy life whatever is more meaningful to you as Wealth!

Relevant Reads>>>