Content Summary

What is Crypto?

"Crypto" is a term commonly used to refer to cryptocurrencies, which are digital or virtual currencies that use cryptography for security. Cryptocurrencies are decentralized and typically operate on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Here are some key points about cryptocurrencies:

- Digital Nature: Cryptocurrencies exist only in digital form. There are no physical coins or bills. They are stored in digital wallets, which are software or hardware tools that allow users to send, receive, and store cryptocurrencies securely.

- Decentralization: Unlike traditional currencies issued and regulated by governments (fiat currencies), cryptocurrencies are often decentralized. They operate on a network of computers (nodes) that validate and record transactions. This decentralization means they are not controlled by a single authority, such as a central bank.

- Cryptography: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. Public and private keys are used to sign and verify transactions, providing a high level of security.

- Blockchain Technology: Most cryptocurrencies operate on a blockchain, which is a digital ledger that records all transactions across a network. This technology ensures transparency and immutability of transaction history.

- Anonymity: While transactions are recorded on a public ledger, users are often identified by a pseudonymous address rather than their real identity. This can provide a degree of privacy, but it's important to note that transactions can still be traced under certain circumstances.

- Variety of Cryptocurrencies: There are thousands of cryptocurrencies, each with its unique features and use cases. Bitcoin (BTC) was the first and remains the most well-known cryptocurrency, but there are many others like Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and more.

- Investment and Utility: Cryptocurrencies can be used for various purposes, including online purchases, investment, transferring money across borders, and participating in decentralized applications (dApps). Some people invest in cryptocurrencies with the expectation that their value will increase over time.

- Volatility: Cryptocurrency markets are known for their high volatility. Prices can fluctuate significantly in a short period, which presents both opportunities and risks for investors and users.

- Regulation: Cryptocurrency regulation varies by country. Some nations have embraced cryptocurrencies, while others have imposed strict regulations or even bans. Regulatory environments are evolving as governments seek to address potential risks and opportunities associated with cryptocurrencies.

Cryptocurrencies have gained significant attention in recent years, both as a financial investment and as a technology with the potential to disrupt traditional financial systems. However, they also come with certain challenges, such as regulatory and security concerns, that should be considered when dealing with them.

What is the Best and Most Efficient Way to Trade and Invest in Crypto?

Have you ever ventured into cryptocurrency investments and wondered about the outcomes? Have you contemplated the idea of generating passive income online? I'm in pursuit of online income opportunities and have been exploring various systems. Here's what I've discovered and have been actively testing.

First things first, what's the price tag of this venture? So you can decide without diving into all the details

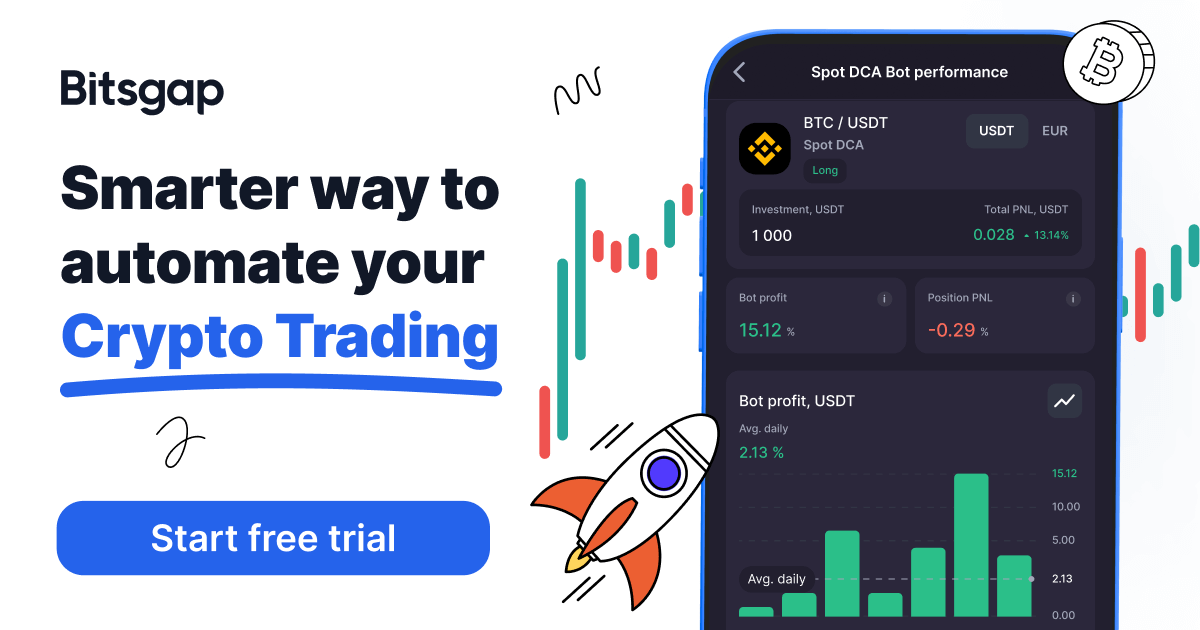

This platform offers three subscription plans:

Basic for $23/month,

Advanced for $55/month

Pro for $119/month

The primary distinction lies in the number of active bots you can run simultaneously—2 for Basic, 5 for Advanced, and 15 for Pro. There are additional variations you may want to review, but with regard to the bots, these are the key differences.

The cost-effectiveness of these plans depends on your trading capital and location; they might be affordable, reasonable, or expensive. Personally, after experimenting with the free trial, I started with the Basic plan (which was self-sustaining during the bull run). Later, I opted for the Advanced plan since, honestly, 2 bots felt somewhat limited (although 5 still doesn't justify the $119 for me).

But what about these bots?

Well, before we delve into that, a quick word of advice—take some time to thoroughly understand how the trading algorithms function. You might not need a perfect grasp, but having a solid concept of what a grid bot entails is essential, as all the bots here essentially operate as grid bots with a few nuances.

Absolutely, let's dive a bit deeper into these bots.

The essence of these bots lies in their grid trading strategy. Grid bots are designed to exploit price fluctuations within a predefined range, allowing you to profit from market volatility without needing to be glued to your screen 24/7. It's a fascinating approach, but it's not without its intricacies.

These bots continuously place buy and sell orders within a specific price range, creating a grid. When the market moves, these orders can get triggered, and you benefit from the price oscillations. However, understanding how to set up your grids, which cryptocurrencies to trade, and when to adjust your strategies is where the art of cryptocurrency trading truly comes into play.

Before you unleash these bots, I highly recommend taking the time to understand the nuances of grid trading. Familiarize yourself with concepts like setting grid spacing, considering market trends, and comprehending the assets you're trading. It's the key to maximizing your profits and minimizing risks.

So, have you given any thought to using these grid bots in your cryptocurrency trading endeavors? It's an intriguing opportunity, but as with any investment, it's essential to educate yourself and be prepared for both the successes and challenges that might come your way.

Certainly, let's continue our exploration

One notable advantage of using these grid bots is the potential for automation. With multiple active bots at your disposal, you can diversify your cryptocurrency portfolio and apply different strategies simultaneously. This automation can free up your time, allowing you to explore other opportunities or simply enjoy a more hands-off approach to trading.

However, keep in mind that even with automation, you should regularly monitor your bots and adjust your strategies as market conditions change. Cryptocurrency markets are highly dynamic and can be influenced by various factors, so staying informed is essential.

Furthermore, it's crucial to remember that past performance is not a guarantee of future success. Cryptocurrency markets can be volatile, and no trading system, no matter how sophisticated, is foolproof. Always invest what you can afford to lose and conduct thorough research before committing to any trading system or cryptocurrency investment.

If you have any more questions or if there's a specific aspect of cryptocurrency trading or these grid bots you'd like to delve into further, feel free to ask. Your understanding and due diligence are the keys to making informed decisions in this rapidly evolving space.

Here is a quick video tutorial on how these bots work to make you money on automation>>>

Bottom Line is You have nothing to lose exploring for free and demo mode learn how it works and invest when you are more confident!

Good Luck! Get your Free Trial Today :) See you on the other side !!!